Today, 01/11/24 the release of the December U.S. – CPI data triggered the S&P 500 (SPX) to move marginally above its 12/28/23 high.

The daily SPX chart courtesy of Trading View updates the action.

Bearish momentum continues. Daily – CCI still has a significant bearish divergence. RSI now has a double bearish divergence vs. its 12/19/23 high. Also note RSI is still below its moving average line.

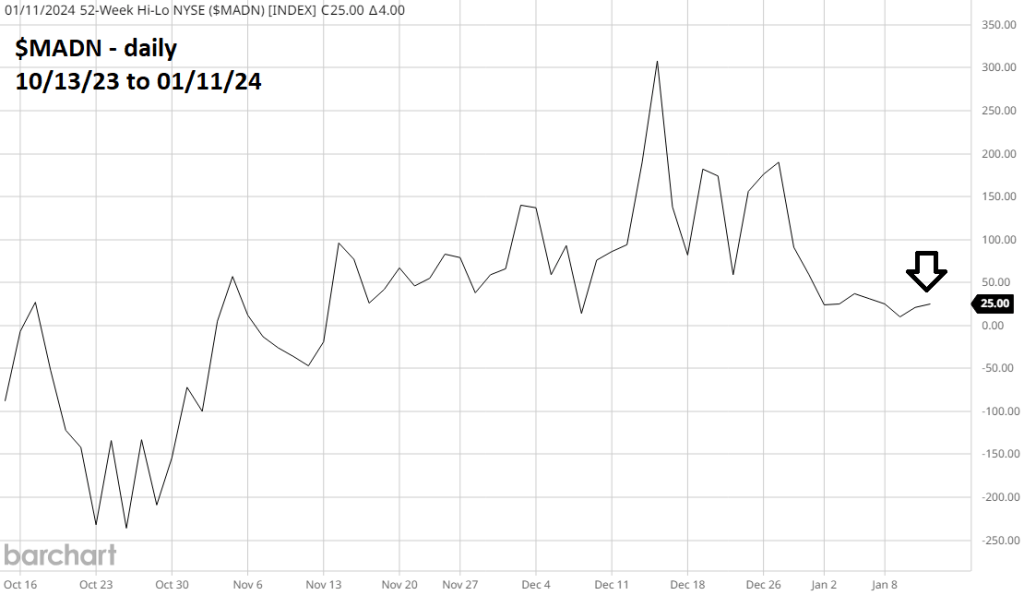

The daily NYSE – 52 – week Hi – Lo ($MADN) updates internal momentum.

$MADN had a tiny move up and is still far below its readings made in late December.

Today, after the SPX open and marginal new post October rally high, it fell nearly 60 – points. The subsequent rally was relentless and nearly retraced the entire early day drop.

In spite of slowing momentum the U.S. stock bulls continue to “buy the dip”.

The U.S. December PPI report is due to be released at 8:30 AM – EST – 01/12/24.