On rare occasions markets have events that could be called “Psychological Signposts”. These events indicate extreme bullish/bearish sentiment near the end of significant market movements.

A classic example of a Psychological Signpost happened in Gold during 1999. During that year some mutual funds focusing on Gold Mining companies closed due to lack of investor demand. The mutual fund closures came near the end of a massive nineteen – year Gold bear market.

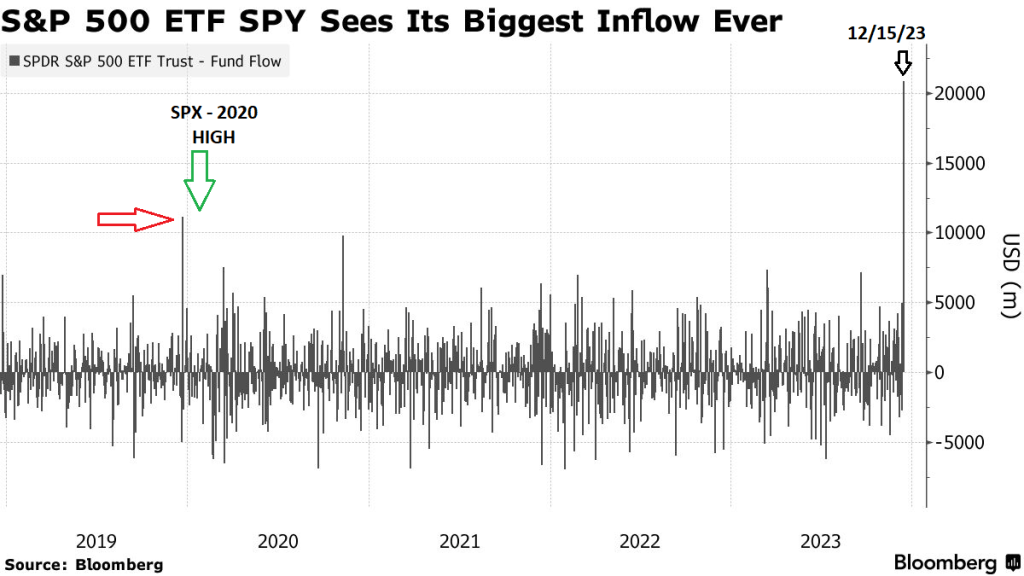

The yearly chart courtesy of Bloomberg shows the inflows to the S&P 500 – SPY – ETF since 2019.

SPY is the worlds largest ETF, on 12/15/23 it recorded its largest inflow ever. Note that the next largest spike happened late in 2019 which was a little more than a month before the S&P 500 (SPX) bull market peak in February 2020. What followed was the February to March 2020 crash.

The massive inflow into SPY is an indication of extremely bullish sentiment. A significant SPX top could be coming soon.

Another Psychological Signpost comes from the Bank of Montreal which recently launched a four times leverage S&P 500 – ETF.

They didn’t launch this fund at the March 2020 crash bottom. They didn’t launch the fund at the October 2022 bear market bottom, or at the intermediate bottom in October 2023. No, they launched the fund after the SPX rallied 15% and was nearing its all-time high. And why now? Because of high investor demand.

Near – term the SPX manic rally since 10/27/23 continues with a new rally high made on 12/27/23. There’s still a good chance for at least a multi-day decline prior to what could be a very important U.S. stock market peak in January or February 2024.