There are no perfect market indicators. Traders can however increase their chances of success by understanding how an indicators behaves by itself, or in conjunction with other market indicators.

Recently I’ve begun a study of the Commodity Channel Index, the following is a description of the indicator.

“The Commodity Channel Index (CCI) measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far above their average. CCI is relatively low when prices are far below their average.”

Comparing the CCI to the Relative Strength Index (RSI) on the S&P 500 (SPX) has revealed some interesting insights.

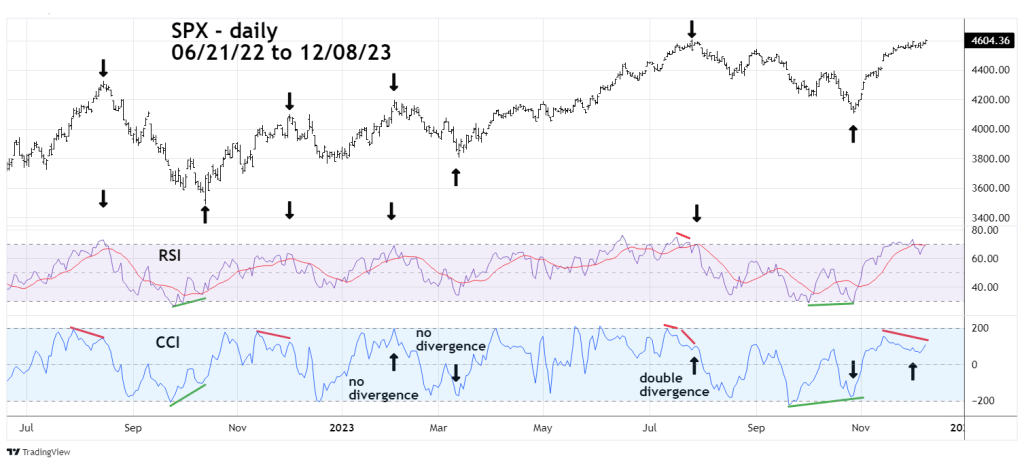

The daily SPX chart courtesy of Trading View illustrates the actions of CCI and RSI.

Usually when RSI reaches an extreme high either in the overbought zone above 70% or below 70% it’s a bullish signal for stock indices. Because stock indices generally trend up slower than individual stocks or commodities, RSI will frequently have at least one bearish divergence before a stock index peaks.

An occurrence of the daily SPX making a significant peak without an RSI bearish divergence occurred in August 2022. However, the CCI had a significant bearish divergence implying a downturn.

The next downturn shows both indicators with bullish divergences.

The December 2022 top shows an example of a CCI bearish divergence catching a short-term top.

For the top in February 2023 and the bottom in March 2023 neither indicator had divergences.

The July 2023 top shows the CCI with a double bearish divergence vs. the RSI single bearish divergence. The CCI gave greater emphasis to a potential decline.

At the October 2023 bottom RSI had an insignificant bullish divergence. The CCI had a greater divergence giving a stronger hint that something bullish could be developing.

The most recent action is fascinating. Note that on 12/01/23 CCI had a bearish divergence while RSI did not. At the 12/08/23 SPX higher peak both indicators have bearish divergences implying at least a short-term decline.

The standard CCI boundary for overbought is +100. The standard boundary for oversold is -100. I’ve modified the boundaries for CCI use with the SPX to +200 and -200. This helps to identify price extremes more easily.

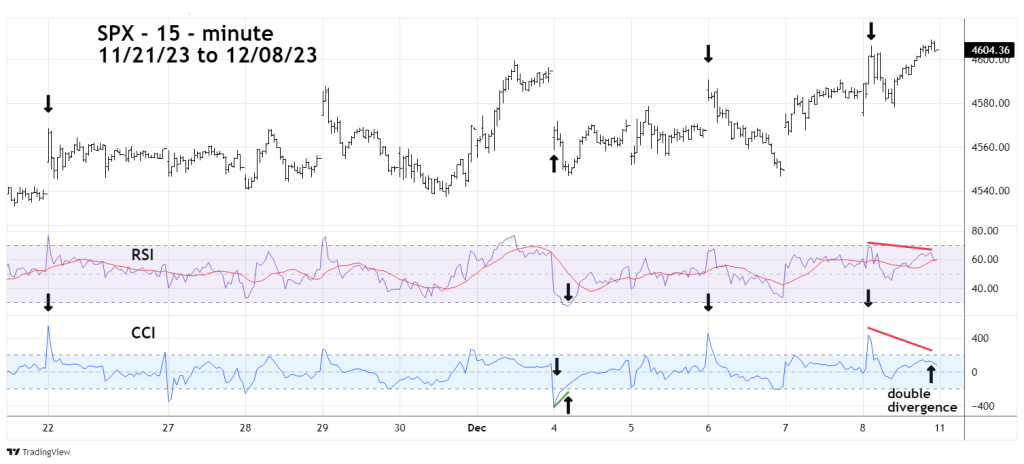

The 15 – minute SPX chart shows how these boundaries can help discover intraday SPX price extremes.

On the SPX 15 – minute time scale I’ve discovered that CCI moves above +400 and below -400 usually correspond with price extremes. These large CCI spikes typically occur soon after the opening of the SPX session.

The CCI spike up on 11/22/23 caught the SPX high of the day.

After the opening CCI spike down on 12/04/23 the SPX had a failed rally. However, note what happened after the next decline. The CCI went up as the RSI dropped into the oversold zone, signaling that perhaps the bears were exhausted.

The CCI spike up on the12/06/23 opening is another example of CCI catching the high of the day.

Finally, the intraday actions of CCI and RSI on 12/08/23 support the bearish readings from the daily SPX chart.