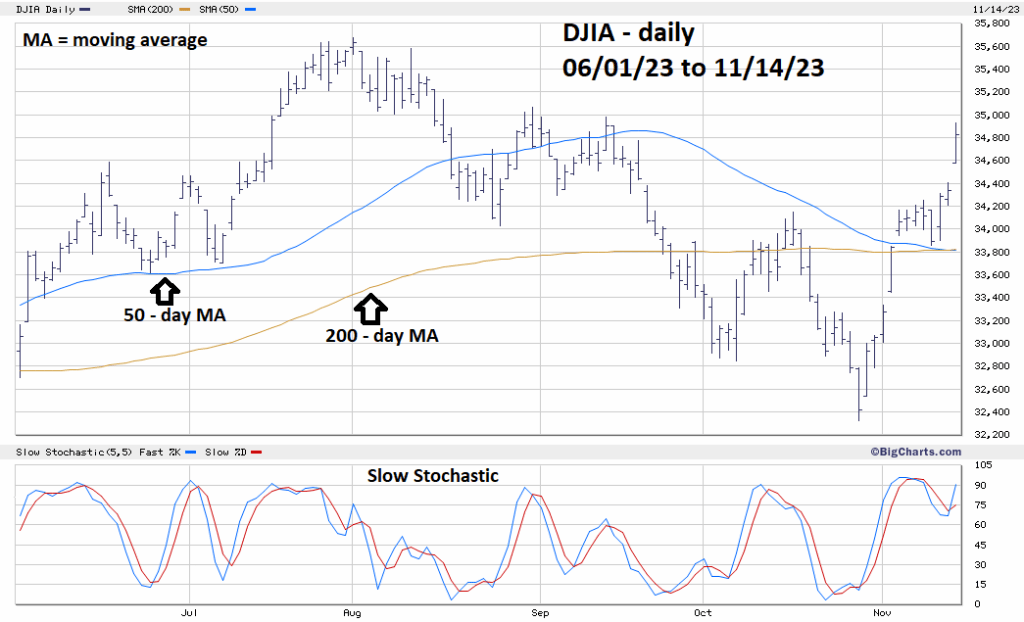

In March 2022 the Dow Jones Industrial Average (DJIA) had a “Death Cross” and in the same day made a secondary bottom. On 11/13/23 the DJIA had a marginal “Death Cross” and made a minor bottom. Today, 11/14/23 there was a massive rally.

The daily DJIA chart courtesy of BigCharts.com illustrates the action.

Todays giant rally blew away internal and external bearish momentum divergences, the S&P 500 (SPX) moved decisively above Fibonacci .618 resistance.

Seasonal stock market patterns are bullish until at least late December/early January.

There’s a high probability the DJIA could reach the July 2023 top, and a good chance of reaching the area of the all -time high made in January 2022.

Traders were holding half of a 50% short position on non – leverage SPX relate funds initiated at the SPX open on 10/13/23. The stop loss was at SPX 4,450. The SPX opened today at 4,459.00 a 2.2% move up from the SPX 10/13/23 open. The loss of 50% of half a position was 0.56%.