A sudden move up in longer-term U.S. interest rates/yields could trigger a panic in U.S. stocks.

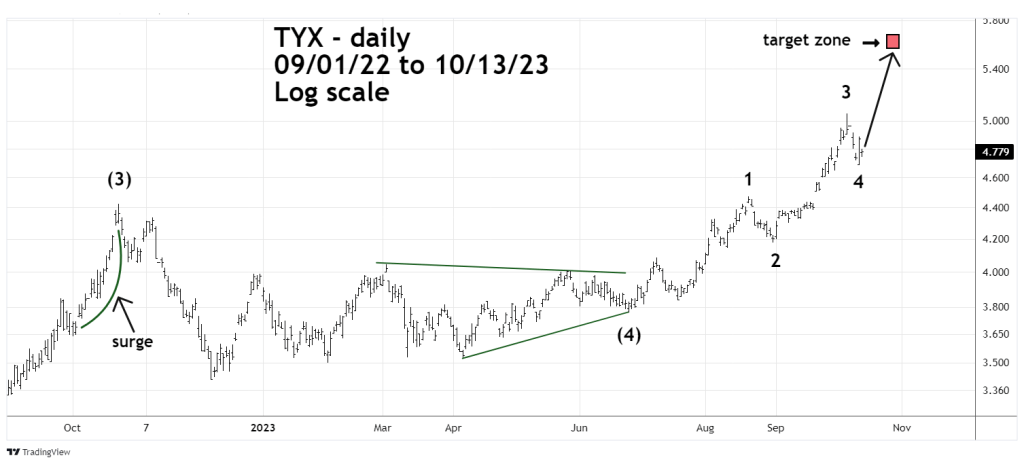

For several months the Elliott wave patterns for the U.S. 30- year Treasury Yields (TYX) have been exceptionally clear. The 09/21/23 blog “Upside Target for U.S. Treasury Yield” noted that TYX could continue climbing into mid or late October 2023. The bullseye upside target is 5.665.

The daily TYX chart courtesy of Trading View updates the action.

It appears that Minor wave “5” of Intermediate wave (5) may have begun. Note the surge up in TYX that occurred in October 2022. Perhaps there could be a similar surge in October 2023.

The move up in longer-term interest rates makes home and auto loans more expensive. It also effects margin rates for stock purchases.

Within recent months there has been an inverse relationship between U.S. stocks and interest rate movements. Note that on 10/12/23 a sharp S&P 500 drop happened with a sharp move up in TYX.

It’s possible a continued rise in TYX could trigger declines in U.S. stocks.

Stocks are seasonally bearish in October; this year the season could go into early November. The next U.S. – FOMC short -term interest decision is due 11/01/23. If they raise rates it could extend a stock market decline into the first few days of November.

Watch TYX.