The next U.S. FOMC decision on short-term U.S. interest rates is 09/20/23. Between now and then there’s likely to be considerable speculation on what action the FOMC could take. Rather than partake in a guessing game, focus on what’s happening at the long end of the U.S. interest rate curve.

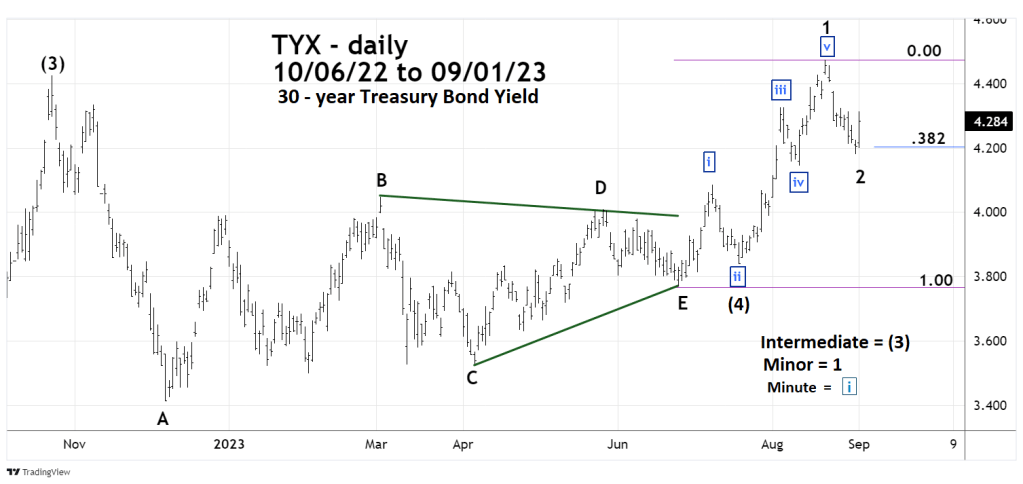

The daily CBOE 30 – year Treasury Bond Yield chart (TYX) courtesy of Trading View illustrates the Elliott wave count since October 2022.

This is an update to the TYX Elliott wave count illustrated in the 07/27/23 blog “Rising Long – Term Interest Rates – 07/27/23”. The TYX Elliott wave count has been very clear and accurate, giving us a preview of what could happen at the long end of the U.S. yield/interest rate curve.

Note that the high on 08/21/23 labeled Minor wave “1” exceeded the peak made on 10/24/22 labeled Intermediate wave (3). Also note that the rally after the Intermediate wave (4) bottom took the form of a clear Elliott Impulse wave.

This five – wave pattern could also be labeled Intermediate wave (5) which implies a significant peak followed by a possible multi-month decline. However, there are two hints that a rally to new highs could be underway. The recent decline terminated almost at a Fibonacci .382 retracement of the prior five – wave rally. Also note the strong move up made on 09/01/23 just after the release of the monthly U.S. jobs report.

A move below 08/31/23 bottom could open the door to at least a multi- day decline. The 06/26/23 bottom labeled Intermediate wave (4) is very important support. A move below that level implies a significant top was made on 08/21/23 and a multi-month decline could be in development.

The weekly chart shows the 30 – year U.S. Mortgage rate (US30YMR).

The current level of U.S. Mortgage rates is probably already having an adverse effect on the U.S. economy. A further increase in these rates could considerably weaken the economy. Perhaps triggering a sudden and deep decline for U.S. stocks.

Watch the TYX.