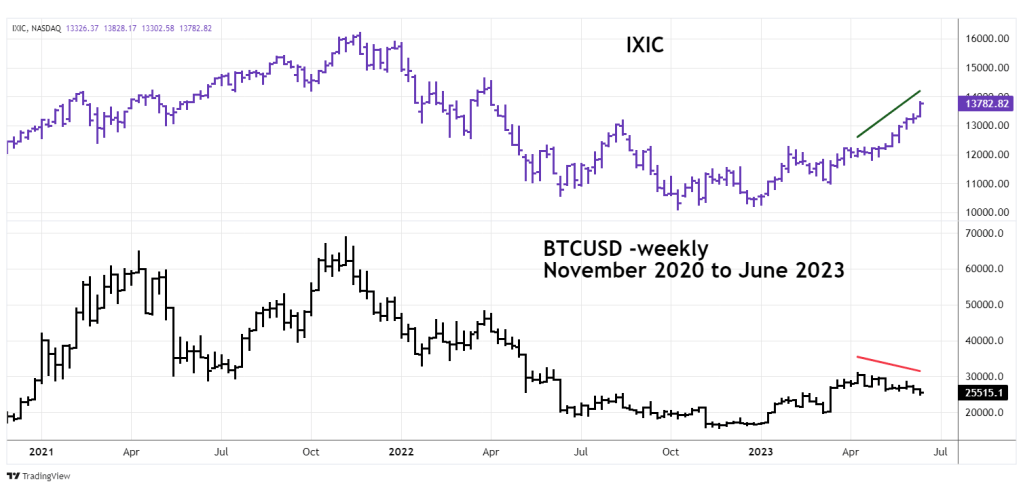

Bitcoin in U.S. dollars (BTCUSD) has a close relationship of trending with the Nasdaq Composite (IXIC). Since April 2023 the two markets have separated. Its possible the current BTCUSD bear trend is a warning sign for a significant IXIC decline.

The weekly BTCUSD and IXIC chart courtesy of Trading View illustrates their relationship since November 2020.

The rally in U.S. stocks since the March 2023 has been narrow and lead mostly by the technology sector. This narrowness of speculation also extends to another market. While IXIC has been in a robust rally since April 2023, BTCUSD has been in a downtrend. About 3 – hours before the IXIC 6/15/23 session began, BTCUSD made a new low in its decline since its 04/14/23 peak.

IXIC surged up strongly on 06/15/23 and could be making a blowoff top. There are two time cycles indicating a potentially important turn for U.S. stocks – late June 2023. If IXIC continues to rally with BTCUSD lagging, U.S. stocks could be poised for a sharp July decline.