Several weeks ago, it appeared the S&P 500 (SPX) could be forming an Elliott wave – Inverse Horizontal Triangle from the 06/17/22 bottom. This wave count is now invalid. Recently this website noted that the SPX may be forming an Elliott wave – Ending Diagonal Triangle from the 10/13/22 low. This wave count could still be under construction.

There’s another wave count based on the SPX since action after 05/04/23 that looks interesting.

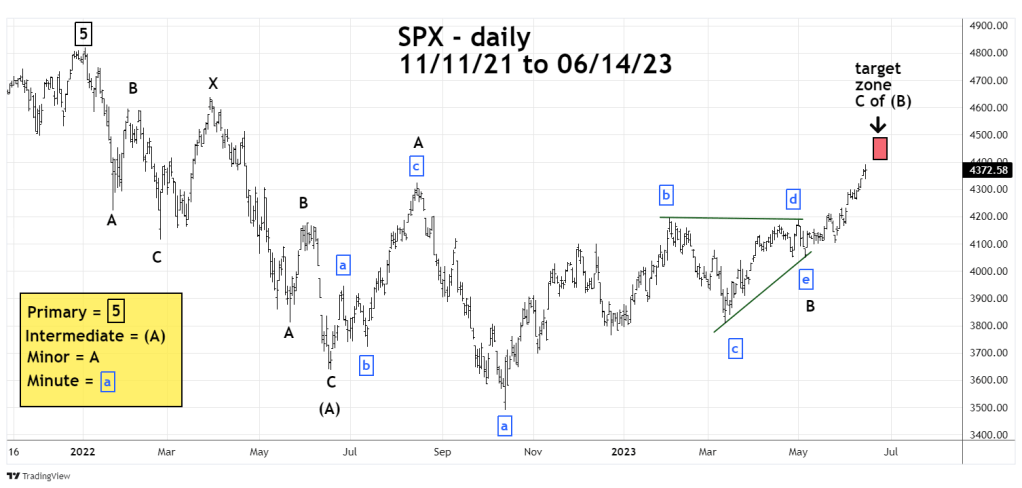

The SPX daily chart courtesy of Trading View illustrates a possible developing Elliott wave count.

Elliott wave – Horizontal Triangles form in the fourth wave position of motive patterns and in the wave “B” or “X” positions of corrective patterns.

In this case the presumed Horizontal Triangle begins at the 08/13/22 peak and terminates at the 05/04/23 bottom. The Zigzag rally from 06/17/22 to 08/13/22 is Minor wave “A”, the rally after the 05/04/23 bottom could be Minor wave “C” that completes the corrective pattern – Intermediate wave (B).

Typically, after a Horizontal Triangle there’s a thrust in the direction of the current main trend. The strong persistent move up from the SPX 05/04/23 bottom looks like a thrust. If this wave count is correct a near-term decline could be brief – perhaps only one or two trading days, followed by a terminal move up.

There are two fascinating time cycles indicating a major turn could develop in late June 2023. If the SPX rallies into late June it could be an important peak. Contingent on market action a blog will detail the two potential time cycles.