The action of U.S. stocks continues to be amazing. On 06/09/23 the S&P 500 (SPX) ended the session up from the prior session close. Yet for most of the trading day more stocks on the NYSE declined than advanced. At the close of the 06/09/23 session 33% of NYSE stocks advanced vs. 64% declining. It’s the second day in a row this unusual and bearish phenomenon occurred.

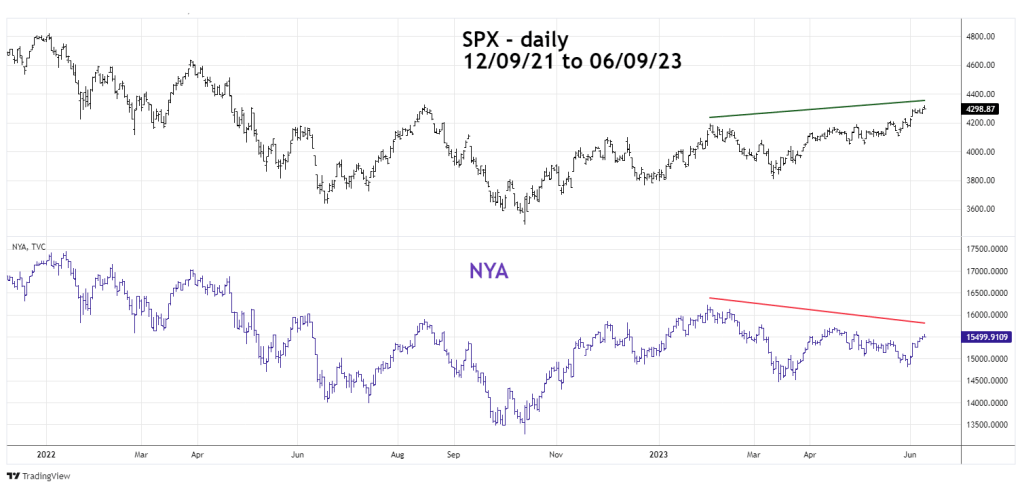

For several weeks this website has illustrated several bearish divergences occurring in the U.S. stock market. This daily chart courtesy of Trading View gives another perspective, comparing the SPX with the NYSE Composite (NYA).

A case could be made that many stocks and even stock sectors are already in a bear market.

The next daily NYA chart shows its prime Elliott wave count from the October 2022 bottom.

This website has illustrated that both the SPX and Dow Jones Industrial Average could be in the process of forming Elliott wave Inverse Horizontal Triangles. Its possible the NYA may have completed an Inverse Horizontal Triangle.

There are usually Fibonacci relationships between alternate sub waves of Horizontal Triangles.

In this case Minor “D” is .513 of Minor wave “B”, close to the Fibonacci ratio .50.

Minor wave “E” is .602 of Minor wave “C”, close to the Fibonacci ratio of .618.

Sometimes wave “E” can have a throwover of the trendline connecting waves “A” and “C”. This presumed Inverse Horizontal Triangle does have a throwover.

On 06/09/23 the SPX opened above 4,300.00 which was the stop loss level for the second half of an inverse SPX fund position initiated at the open of SPX trading on 05/17/23. The total SPX percentage move from 05/17/23 to 06/09/23 was 4.4% a loss of 2.2%.

The Volatility S&P 500 index (VIX) could very soon give another topping signal. The next blog will examine the history of VIX topping signals from 2007 to 2023.