Today 06/01/23 the S&P 500 (SPX) made a new post October 2022 rally high unaccompanied by either the Dow Jones Industrial Average, or the Nasdaq Composite. A bearish “Rule of the majority signal. Additionally, the VIX low today was 15.58 vs. its 05/01/23 reading of 15.53. This higher VIX bottom retains the VIX topping signal.

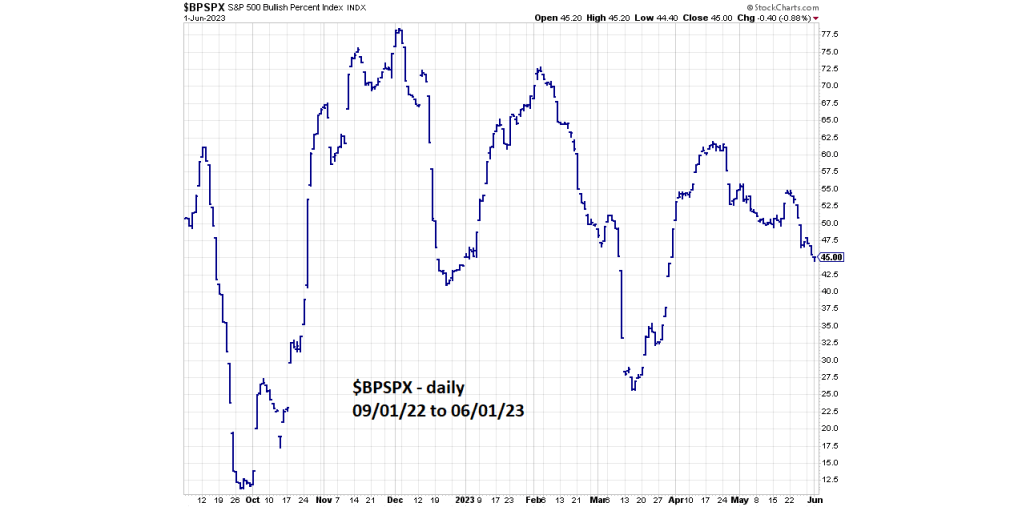

The daily SPX – Bullish Percent Index chart ($BPSPX) courtesy of StockCharts.com illustrates the internal momentum of what is currently the most bullish U.S. stock index.

The SPX opened the 06/01/23 session down, causing &BPSPX to move down. The subsequent SPX rally moved $BPSPX up, but only to 45.00 – just below the prior day low of 45.40. The SPX .98% rally had a loss of internal strength.

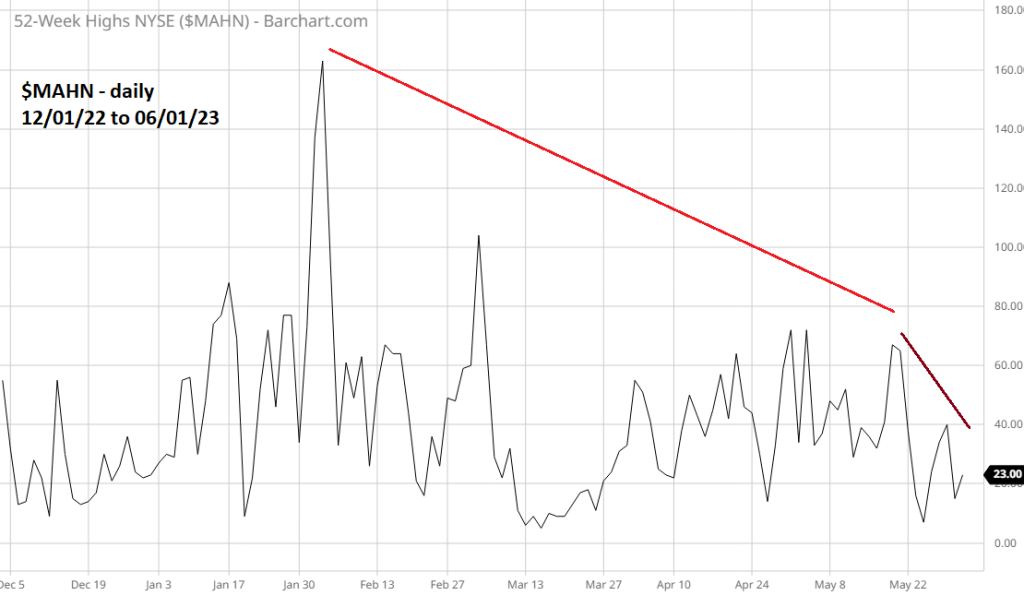

The daily 52 – week NYSE highs ($MAHN) courtesy of Barchart.com shows more internal bearishness. In addition to the significant bearish divergence vs. the 02/02/23 peak there’s now a short-term double bearish divergence.

The 05/30/23 reading is below the 05/18/23 reading, and incredibly today’s reading is significantly below the 05/30/23 reading.

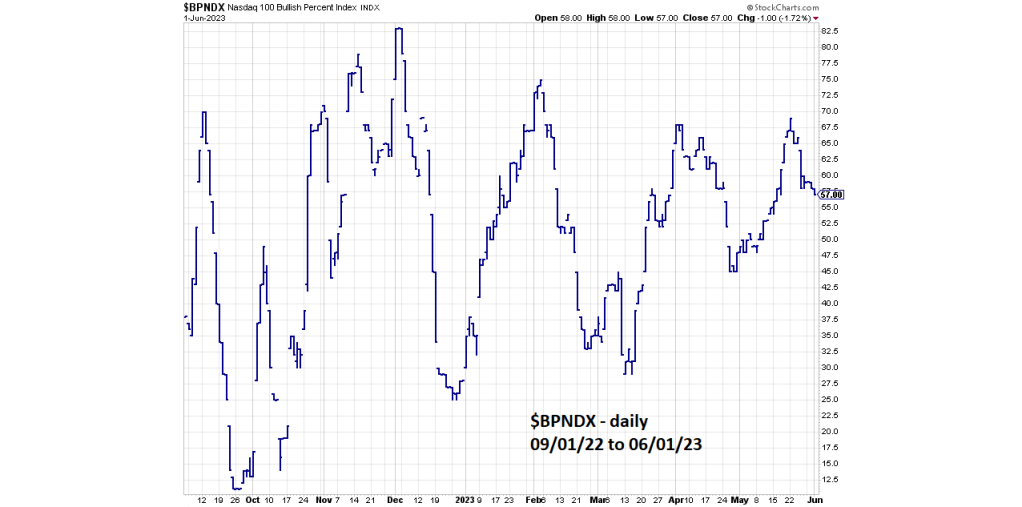

Today the Nasdaq 100 a sub-index of the Nasdaq Composite failed to make a new post October 2022 rally high. However, its rally 1.31% was stronger than the three main U.S. stock indices.

The daily Nasdaq 100 – Bullish Percent Index ($BPNDX) illustrates its internal strength.

On a Nasdaq 100 – 1.31% rally $BPNDX closed one point below its 05/31/23 reading.

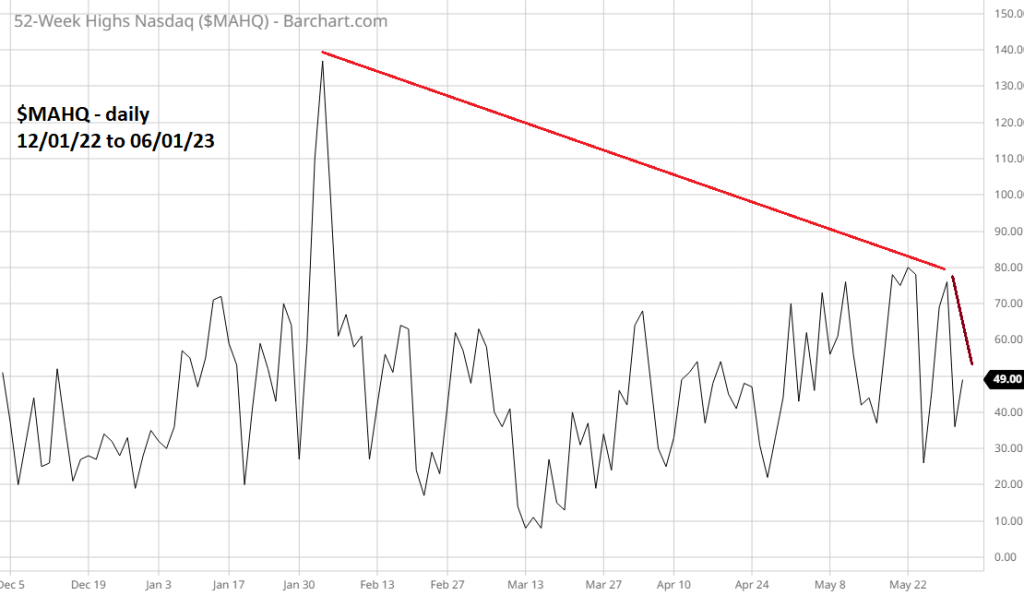

The next daily chart ($MAHQ) shows the Nasdaq Composite – 52- week highs.

Again, a short-term double bearish divergence.

During the last few weeks U.S. stocks have continued to rally, while internal strength has dramatically weakened. This is not the type of action to expect in a sustainable rally.

There could soon be a sharp decline, perhaps starting as soon as 06/02/23.