After sixteen months of a relentless bull market, stock fund managers have learned the lesson: when stocks decline go in and buy.

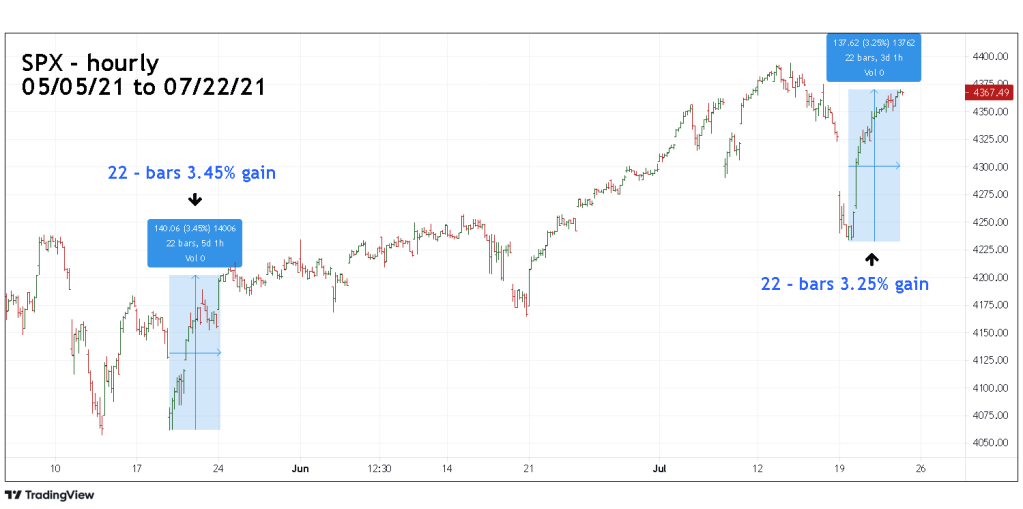

The hourly S&P 500 (SPX) chart courtesy of Trading View illustrates the recent action.

The SPX move up from the 07/19/21 bottom is the fastest and farthest rally since the move from the correction bottom made on 05/19/21. The move up from the 05/19/21 bottom was the kickoff of a multi- week rally into the July peak. A case could be made that the current rally is the kickoff of a new multi- week rally. Internal momentum argues strongly against this theory.

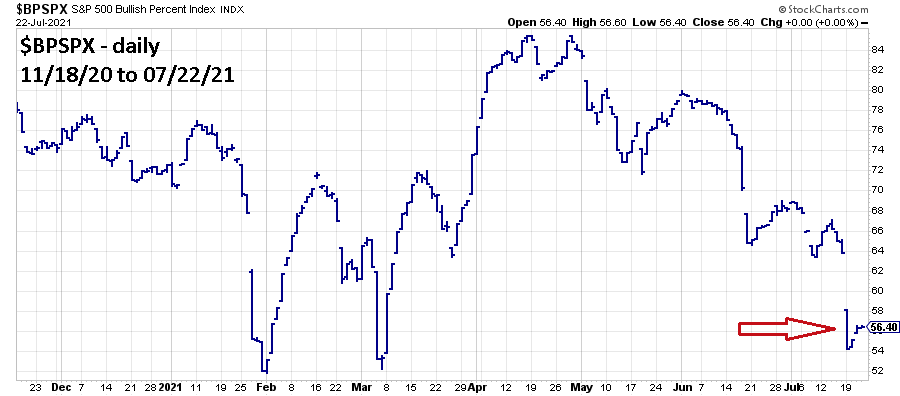

The daily SPX Bullish Percentage chart ($BPSPX) courtesy of StockCharts.com illustrates internal momentum.

Internal momentum which has been weakening for several months continues to be bearish.

Traders are holding 100% short non – leveraged SPX related funds from the open of the SPX session on 07/12/21. Continue holding short.

Thank you, Mark, for your (as usual) sage advice. This week has been a wild ride for the market. I’m glad you’re the expert who keeps us focused and apprised of great opportunities.

LikeLike

Thanks for the compliment.

LikeLike

There is nothing like the “buy the dip” mentality in this market.

It’s” ingrained” into the psyche of traders.

Why..?

Because it has worked countless times before.

It ‘s almost like playing the same tune, again and again.

and coming out a winner.

The only catch here is, there is going to come a time,

just statistical probably alone

when their buying powder is going to comes up “dry ‘

And heaven help the “longs” at that point, when they try to get out.

This V Bottom Formation in the S+P 500

is targeting there all time highs,perhaps as soon as tomorrow, Friday July 23,2021.

Thank you for being here Mark.

Your market analysis is always respected, and appreciated.

Joe Soja

LikeLike

Thanks for the information and compliment.

LikeLike