During the prior three trading days the three main US stock indices slowly climbed higher and have remained below their all-time highs. Most likely this is the first rally within a developing bear market. The trigger for the next stock market drop could come from the Bitcoin market.

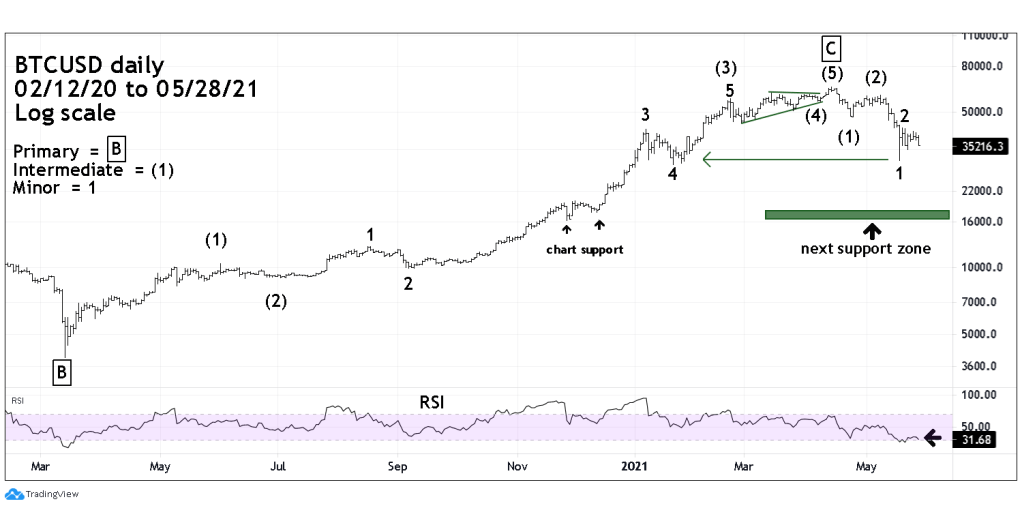

The daily Bitcoin in US dollars (BTCUSD) courtesy of Trading View illustrates its bull market and developing bear phase.

The BTCUSD March 2020 to April 2021 bull market took the form of an extended Elliott impulse wave. The decline from the mid-April 2021 top could also be a developing impulse wave. If the illustrated wave count is correct a break of the May 19th bottom could bring about a steep decline and a change of sentiment.

Within Elliott wave theory there’s a concept known as “the point of recognition” this is the point in which the crowd realizes that the market trend has changed. In this situation it would be where the decline in no longer view as a correction to buy into but as a bear market to sell.

The middle part of an Elliott third of a third wave is usually where the point of recognition occurs. A break of the May 19th bottom could be the point of recognition. If this happens BTCUSD could quickly reach the next chart support area. Supporting this theory is the daily RSI. Note how even after a 50% price decline, RSI was only able to go marginally into the oversold zone. This implies there could be another drop bringing RSI deep into oversold.

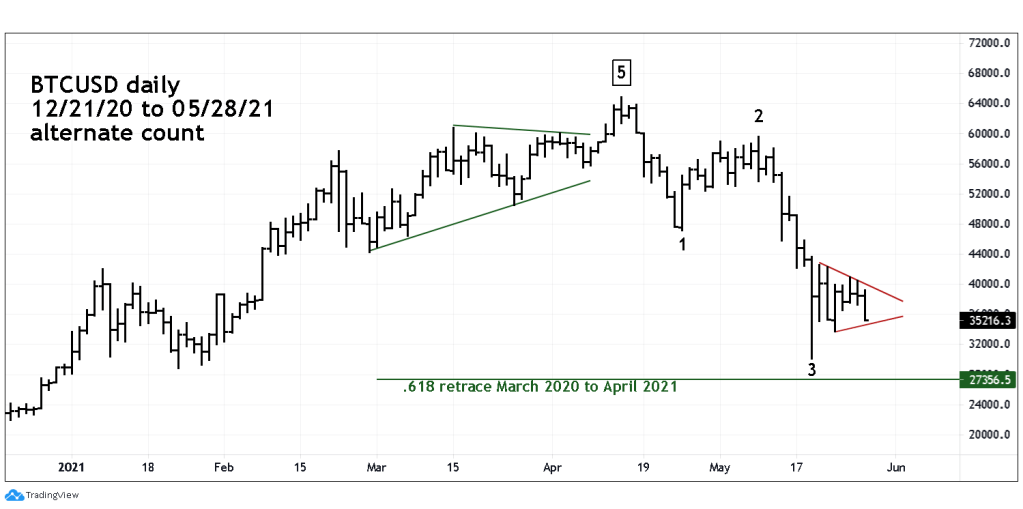

The next chart illustrates a less bearish Elliott wave count.

This count has the next drop as the fifth wave of an impulse pattern with a possible bottom near Fibonacci .618 support. If this count is in correct there could be a multi-week rally after the fifth wave down is complete. This less bearish count also open the door for the main US stock indices to make new all-time highs.

Bitcoin was the speculative leader from March 2020 to April 2021 and could be leading the way down.

Thanks, Mark, for the warning. You are a true warrior on behalf of your many stock market followers. Carry on!

LikeLike

Thanks very much for the compliment.

LikeLike